Earn Dividends

IDProtect®*

Cell Phone Protection*

Online & Mobile Banking

Overdraft Protection

Digital Wallets

AD&D Insurance*

Travel & Leisure Discounts*

Health Discount Savings*

$hopping Rewards™ *

Mobile Banking

24/7 account access through mobile banking app whenever and wherever you are.

Learn More

Online Banking & Bill Pay

Online banking is a quick and efficient way to manage your finances securely. Plus, it’s free!

Learn More

Overdraft Privilege

Courtesy Pay permits you to overdraw your checking account up to $500 (including fees).

Learn More

ATM/VISA Debit Cards

When you open your account, we’ll also give you a free VISA Debit Card. You can use this card just like a check anywhere VISA is accepted. Plus, you can also use it to get cash at thousands of ATMs worldwide through the Pulse network.

The VISA Debit Card makes everyday purchasing quick and easy, because it works like a check and it’s safer than carrying cash. Even better, there’s no need to show ID or wait for approval, so you’re in and out of stores in no time.

The VISA Debit Card is also an ATM card. You can use it at 400,000 ATMs in the VISA/PLUS Global ATM Network. For your convenience, local ATMs are located at the locations below:

- Copperhill Branch

- Blue Ridge Branch

- Kickstart Convenience, Turtletown TN

- IGA Hometown Foods, McCaysville GA

Pick Your Debit Card Design

Scroll through options below…

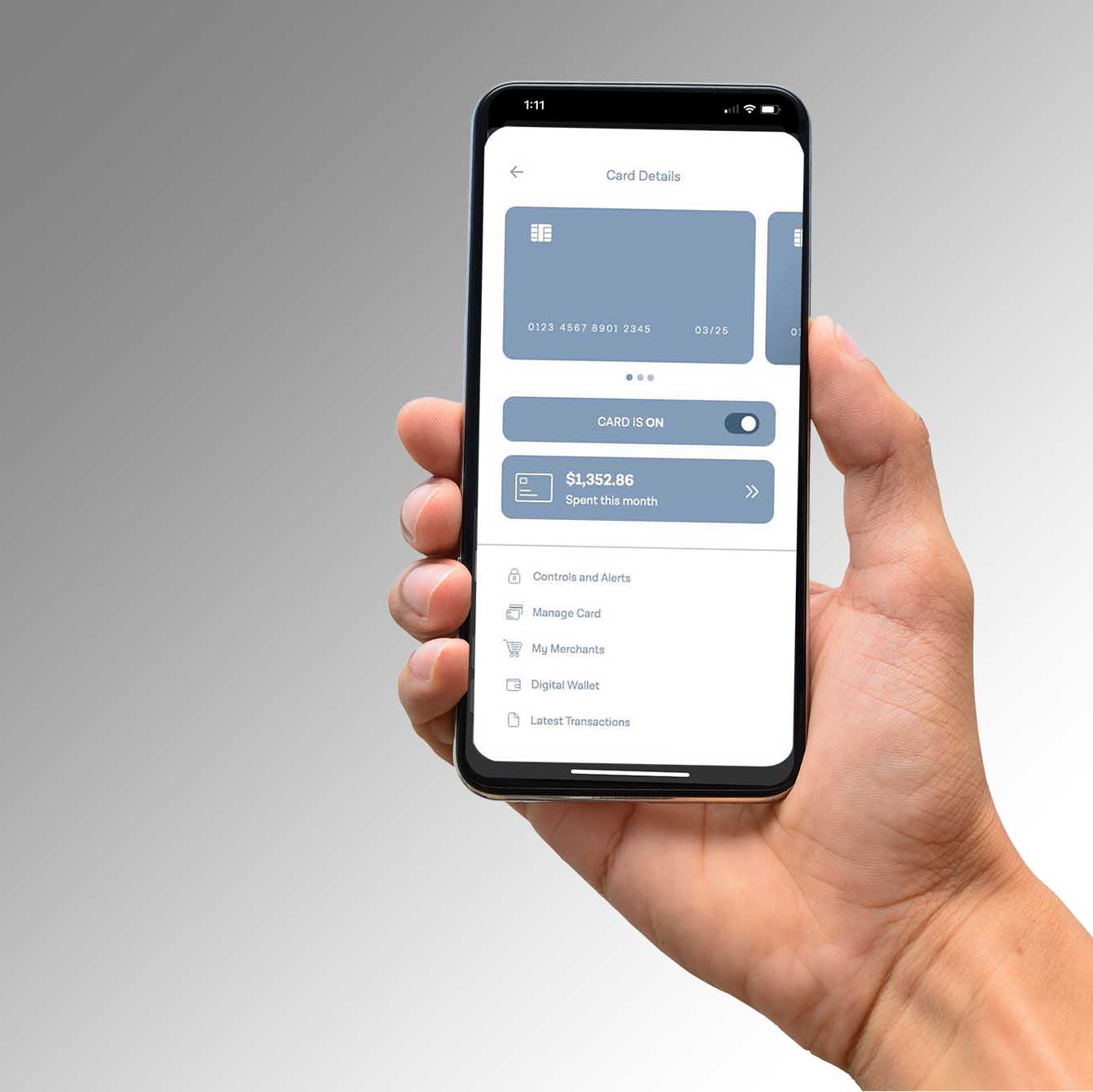

Card Management & Spend Tracking

Introducing card management and spend tracking features in mobile banking. A powerful new way to manage all your card has to offer. Using the card management features, you can:

- Set card controls by location, merchant type, and spending limits.

- View spending insights for a clear picture of when and where you purchases were made.

- Add travel plans so you can use your card worry-free.

- Quickly add your cards to your device’s digital wallet.

- Receive transaction alerts, fight fraud, quickly reach support, and more!

Make sure your app is up to date, and simply tap “My Cards” within the mobile app to get started.

Digital Wallets Available

Digital wallets are mobile apps that securely store your Debit Card information to be available wherever you are. This can be used in-store, online, or in apps, all you need is your phone!

Now you can pay with your CBFCU debit card using Apple Pay, Samsung Pay or Google Pay. Paying in eligible stores is as easy as holding your phone up to a contactless reader.

Easily add your card to your compatible smart phone device and forget fumbling through your wallet to find your card or entering a bunch of info when you’re ready to checkout!

Benefits Of A Digital Wallet

1. Extra Convenience

Whether you’re shopping online, in a store, or in an app, your digital wallet is available with your information for an easy checkout! Most digital wallets let you transfer and request money making it easy to split the bill if out with friends. Transactions are as easy as holding your phone over the payment terminal and verifying the purchase. Most purchases can be completed in seconds and no more typing in your entire card number every time you’re online shopping on your phone.

2. Your information is safe

Digital wallets were built with security in mind. Your information is encoded reducing any security risks. If you misplace your physical card, it is easy for someone to get all your information. With digital wallets, if you were to misplace your phone, they all have a two-step authorization to access the card information, on top of having a password to get into your phone in the first place. Your card is fully linked to your CBFCU online banking account, so you will still be able to see all transactions as if you were still actually swiping the card.

3. Free Access

Digital wallets are free to use whether it’s Apple Pay, Samsung Pay, or Google Pay, there are no extra fees to add in your card! You can have multiple cards in your digital wallet to have your wallet on the go.

Qualifications

A $6.00 monthly fee applies, but can be easily avoided or reduced by:

- Performing 25 debit card swipes per month to reduce the fee by $4

- Signing up for E-Statements to reduce fee by $1

- Direct Depositing your payroll, retirement, or social security checks to reduce the fee by $1

- Perform ALL the above to eliminate the $6.00 monthly fee completely!

Plus, those aged 55+ get one box of free checks per year!

Additional Services

Re-Order Checks

Order Now

Member Services

Learn More

Fee Schedule

Learn More

Debit Card Frequently Asked Questions

Why isn't my debit card being approved for transactions?

I need to purchase an item online/over the phone and the amount is greater than $1500. What do I do?

What are the extra 3 digits found on the signature strip on the back of the card?

My debit card is going to expire next month, do I have to reorder a new one?

No, a new card will be sent before the end of the expiration month, you will need to re-activate the card by calling the 1-800 number.

How much does it cost to have a Debit Card?

There is no monthly fee to have a debit card.

My card is cracking, can I get a new one?

Yes, there is a $5 replacement fee.

My card was lost/stolen, can I get a new one?

Call 1-800-472-3272.

What do I do if I forgot my PIN?

Call toll free 1-800-992-3808 and follow the prompts to reset your PIN.